How Does Telegram Make Money? (Business Model, Revenue Breakdown, & Future Growth)

Telegram has long been one of the world’s fastest-growing messaging platforms, famous for its privacy-first approach, speed, and massive group and channel capabilities. For years, it operated without generating significant revenue, focusing instead on user growth. But in 2024, Telegram reached a major milestone—its first-ever profitable year—and crossed $1 billion in annual revenue.

So, how exactly does Telegram make money without selling user data or heavily targeting ads? Let’s break down the company’s performance, revenue sources, and future plans.

📈 Telegram’s Official 2024 Financial Performance

- First-Ever Profitability: Telegram posted a $540 million profit in 2024, a dramatic turnaround from a $173 million loss in 2023.

- Revenue Growth: Annual revenue jumped from $342 million in 2023 to over $1 billion in 2024.

- Cash Reserves: Over $500 million in cash, excluding cryptocurrency holdings.

- Debt Management: Paid back $375 million in bonds in late 2024, reducing its $2 billion debt.

Related: 5 Tricks to Use Telegram Without Using Phone Number

💰 Main Revenue Streams

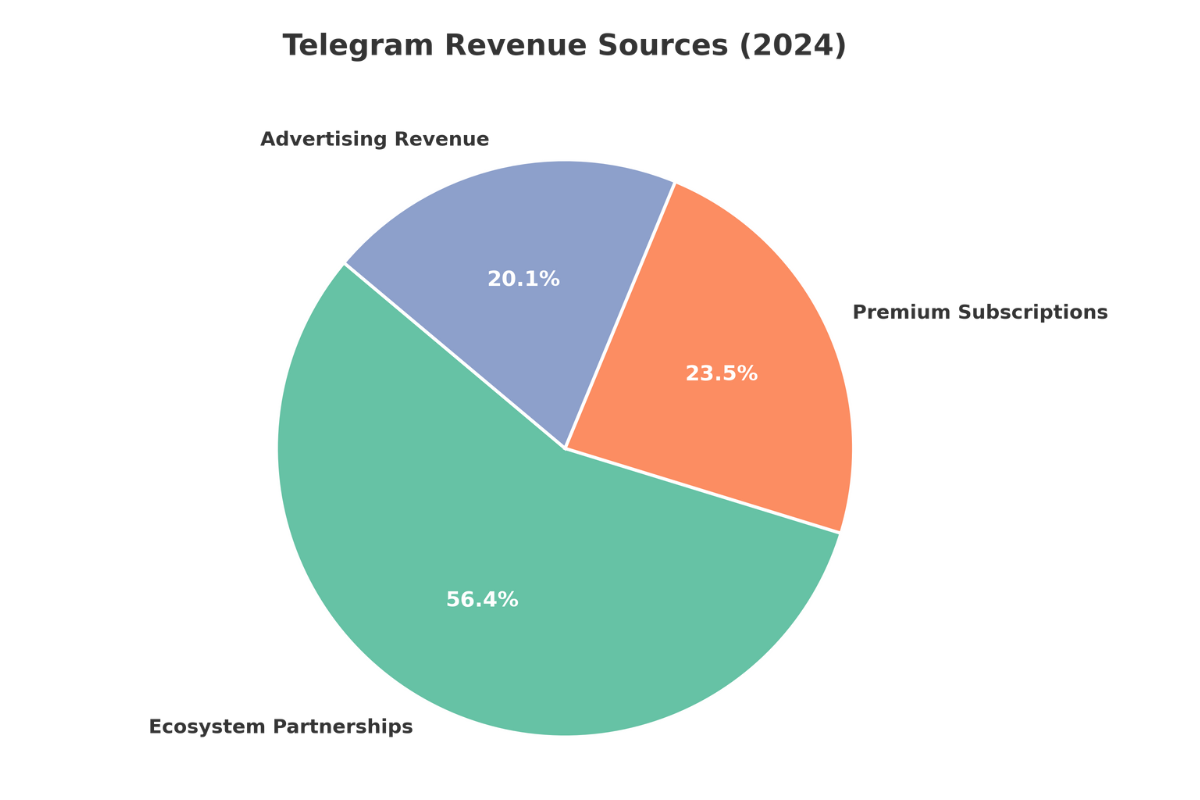

Telegram’s revenue comes from a diverse mix of monetization channels, carefully designed to avoid invasive tracking or data sales.

1. Ecosystem Partnerships (~$700 million | ~50% of total revenue)

Telegram’s largest revenue source is ecosystem cooperation—primarily through integration with the TON blockchain and its growing network of mini-apps. This includes:

- Developer and partnership fees for integrating TON features

- In-app purchases and transactions within mini-apps

- Revenue from third-party services using Telegram’s infrastructure

TON’s blockchain enables payments, digital collectibles, and bot-based commerce—creating a growing digital economy inside Telegram.

2. Premium Subscriptions (~$292 million | ~29% of total revenue)

Launched in mid-2022, Telegram Premium offers exclusive features for a monthly fee of $4.99–$5.99.

Premium perks include:

- 4GB file uploads

- Faster downloads

- Exclusive stickers and reactions

- Ad-free experience

- Advanced chat management tools

Premium subscribers tripled from ~4 million in 2023 to 12 million in 2024.

3. Advertising Revenue (~$250 million | ~25% of total revenue)

Telegram runs a privacy-friendly ad system called Sponsored Messages in public channels with 1,000+ subscribers.

- Ads are text-based and non-intrusive.

- No personal user data is used for targeting.

In March 2024, Telegram launched a revenue sharing program:

- Channel owners keep 50% of ad revenue generated in their channels.

- Payments are made in Toncoin (TON) cryptocurrency.

➕ Additional Revenue Sources

Telegram’s newer monetization initiatives are still growing but could become major contributors in the future:

Telegram Stars Payment System

- For digital goods, paid content, gifts, and service payments.

- Stars can be purchased via in-app payments and used inside Telegram.

Mini Apps & Bot Revenue

- In-app purchases, transaction fees, and developer service charges.

Digital Collectibles & NFTs

- Username auctions, collectible phone numbers, and limited-edition virtual gifts.

Business Services

- Telegram Business subscription fees

- Phone number verification services

- API access charges for enterprises

📅 2025 Outlook and Growth Plans

Telegram’s 2025 financial projections are ambitious:

- Revenue Target: $2 billion (46% YoY growth)

- Profit Target: $720 million

Key drivers for 2025 include:

- Expansion of TON blockchain and payment ecosystem

- Growth in Premium subscriber base

- Increased adoption of Telegram’s ad platform

- Monetization of business tools and mini-apps

🏦 Bonds, IPO Talk & Investor Interest

To support growth and refinance debt, Telegram is issuing $1.5 billion in new bonds. Major global investors—BlackRock, Mubadala, and Citadel—have shown strong interest.

Investor documents hint at IPO preparations, with bondholders receiving rights to purchase shares at a 20% discount if Telegram goes public.

🔒 Privacy-First Business Model

Pavel Durov, Telegram’s founder and CEO, has repeatedly emphasized that:

- User privacy is non-negotiable

- Telegram does not sell personal data

- Ads are non-invasive and don’t rely on tracking

This approach sets Telegram apart from most major social media platforms—and is a key reason for its rapid user growth, which exceeded 1 billion monthly active users in March 2025.

Telegram’s journey from a free, privacy-focused messaging app to a profitable billion-dollar business in just a few years is remarkable. By combining blockchain-powered ecosystems, premium features, and a privacy-friendly ad model, it’s proving that tech companies can scale without compromising user trust.

With an expanding user base, new monetization tools, and the possibility of going public, Telegram’s financial future looks brighter than ever.

Also Read:

1. Best Telegram Channels for Movies

2. Best Telegram Channels for Viral Videos

3. Best Telegram Channels for Memes